Central Bank revises leasing ratios for vehicles

The Central Bank of Sri Lanka has decided to revise the maximum leasing ratios applicable to vehicles. Accordingly, the maximum ratio for commercial vehicles has been reduced to 70 percent, while the limit for private vehicles has been set at 50 percent.

In July this year, the Central Bank had allowed leasing facilities up to 80 percent for commercial vehicles, 60 percent for private vehicles, 50 percent for three-wheelers, and 70 percent for other vehicles.

However, under the latest revision, the four categories introduced in July have been consolidated into two main groups — one for commercial vehicles and the other covering motor cars, vans, three-wheelers, and other vehicles.

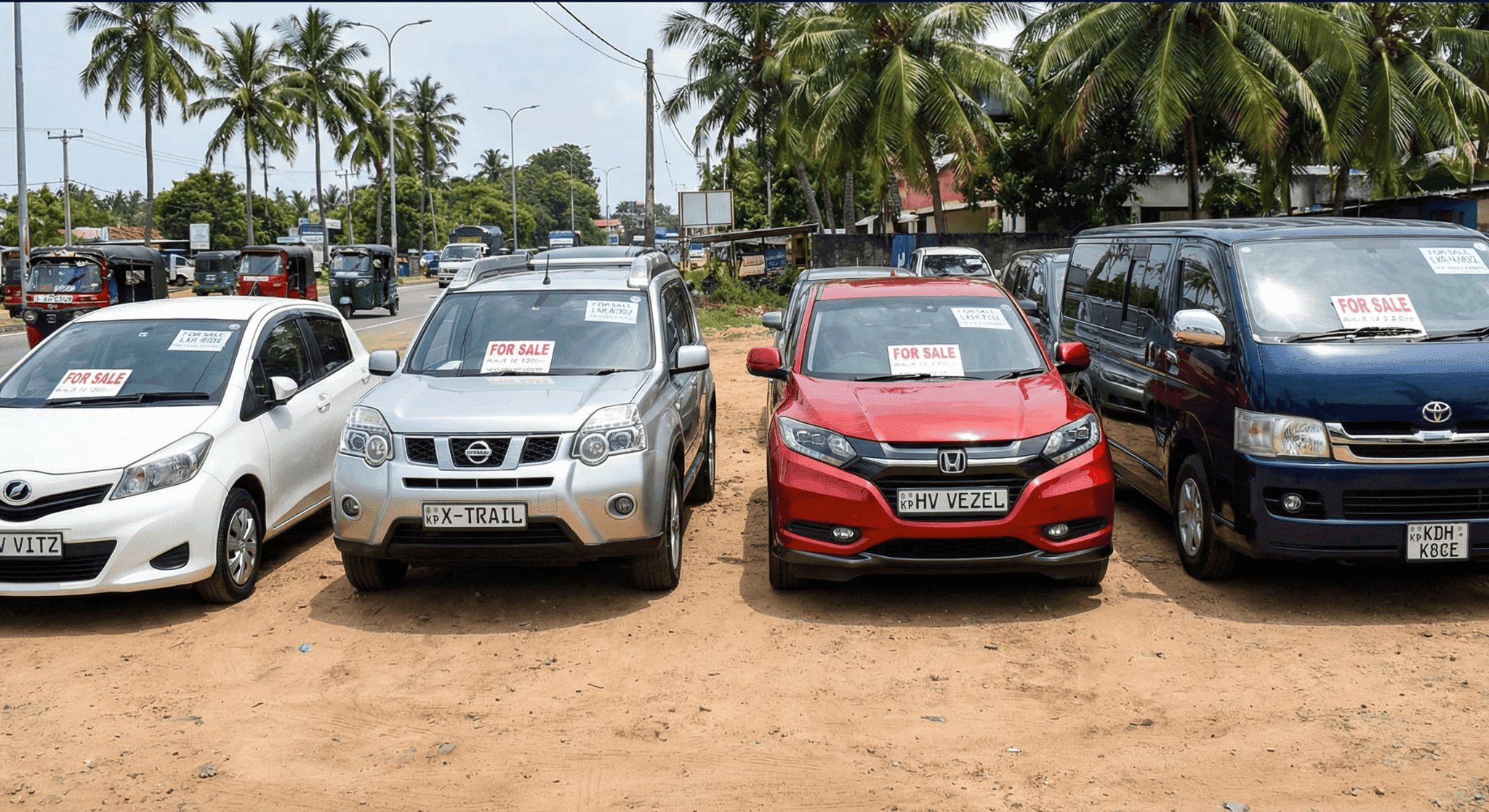

How will this decision of the Central Bank of Sri Lanka affect vehicle prices and the vehicle market?

Economic analysts are of the view that this move has been made to reduce the demand for vehicles. As a result, they expect the current high prices of used vehicles to gradually decline to a more reasonable level. The decision has been structured in a way that does not negatively impact financial institutions and banks that provide leasing facilities.

Since the previous 60% leasing facility for private vehicles will be reduced by 10%, this will create some difficulties for those who were planning to buy a vehicle in the near future. However, analysts point out that if demand drops due to this decision, vehicle prices are likely to adjust to more reasonable levels over the next one to two years.