Things You Need to Know About Third Party Insurance

If you want to drive a vehicle on the road, it is mandatory to have third party insurance. But do you really know what it covers, how claims work, and why it’s required? Today, MotorGuide explains the essential things you must know about third party insurance before getting behind the wheel.

What is Third Party Insurance?

Third party insurance covers financial losses, property damage, physical injury, or legal issues caused to a third party due to your vehicle. It does not cover damages to your own vehicle or injuries to passengers inside it. Instead, it protects the lives and property of the other party involved in the accident.

Can You Claim from a Third Party?

There are two main areas of compensation under third party insurance:

- Property damage – e.g., damage to other vehicles, road infrastructure, or property.

- Life or injury claims – if a third party suffers injury, disability, or loss of life due to your vehicle, compensation is provided to them.

So, third party insurance is not for your own benefit but ensures that victims receive proper compensation.

How to Make a Claim?

If your vehicle gets into an accident, here’s how a third party claim works:

- If both vehicles have third party insurance, the at-fault party’s insurer will pay compensation to the victim.

- If only your vehicle has insurance, but the other one doesn’t, and the uninsured party is at fault, they must still pay compensation personally and face legal fines for not having insurance.

To file a claim, you must first report the accident to the police. Then, the case proceeds to court where liability is decided. Based on the verdict, the insurance company will pay compensation according to the coverage limits mentioned in the policy.

Why is Third Party Insurance Required?

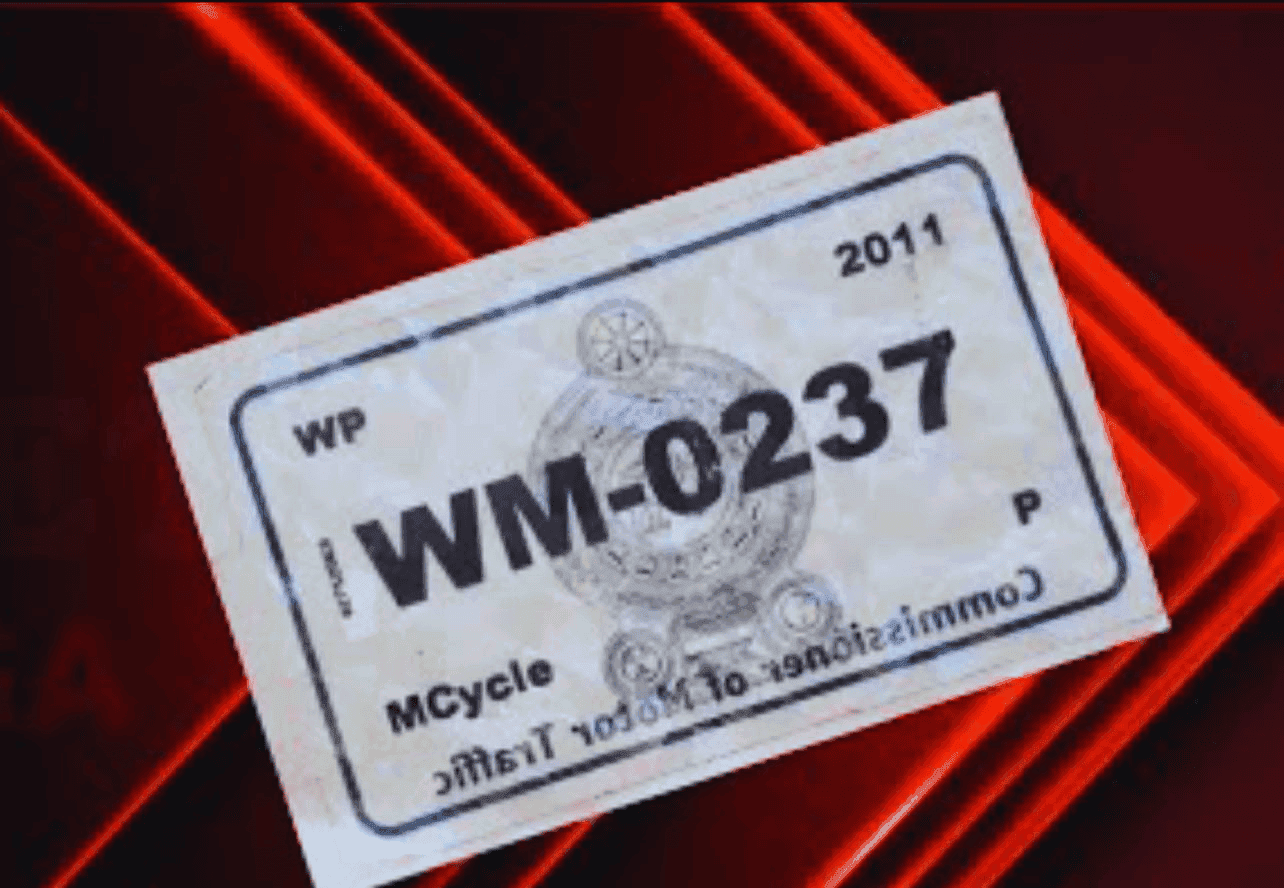

Driving without third party insurance is illegal. If the police stop you and you don’t have it, you can face court fines or penalties. More importantly, without it, you may have to personally bear huge expenses if your vehicle causes damage to another person or property. That’s why third party insurance protects not only others but also your financial security.

Claim Process with the Insurance Company

The claim procedure involves three parties: the insurance company, the policyholder, and the third party. After investigation and court confirmation, if the policyholder is at fault, the insurer pays compensation. If the insured driver is found innocent, then no compensation is paid, and both the insurer and driver are released from liability.

How Much Compensation Will the Third Party Receive?

The amount depends on the case and the insurance company’s coverage terms:

- Loss of life or total disability – usually unlimited compensation.

- Partial disability – a percentage of the maximum compensation.

- Property damage – subject to a fixed limit specified by the insurer.

Final Thoughts

Third party insurance is not just a formality to drive on the road — it is legal protection for you and financial security for others. While it won’t cover damages to your own vehicle, it ensures that if an accident occurs, the affected party receives fair compensation. Always keep your policy active and updated to avoid legal and financial troubles.