Flood-Damaged Car Insurance Claims: A Step-by-Step Guide

Let's discuss in detail the most critical and financially significant aspect of restoring a flood-damaged vehicle: insurance coverage and damage reporting. Following these steps will help you minimize repair costs and ensure you handle the process correctly and legally.

Insurance Coverage and Reporting Damage

Flood damage is generally considered an accidental damage classified as an "Act of God." In such a situation, following the correct procedure is extremely important.

How to Report the Damage (Documentation)

We can gather evidence using photos and videos.

- Capture Evidence: Immediately take clear, high-quality photos and videos of the damage site, showing the level to which the vehicle was submerged, how water entered, and the mud or damage inside and outside.

- Detail Specifics: Photograph damages to the dashboard, seats, and electrical systems up close so they are clearly visible.

- Do Not Tamper: Do not remove, wash, or alter any damaged parts until the insurance adjuster arrives or the insurance company gives you permission.

- Record the Incident: Note down the exact date and time of the flood, the duration the vehicle was submerged, and the water level (e.g., "up to seat level" or "halfway up the door").

The Insurance Claim Process

Checking Coverage

Flood damage is usually covered under Comprehensive Coverage (Full Insurance). Check your insurance policy to see if it covers floods or natural disasters. This is generally not covered under Third-Party insurance.

Immediate Notification

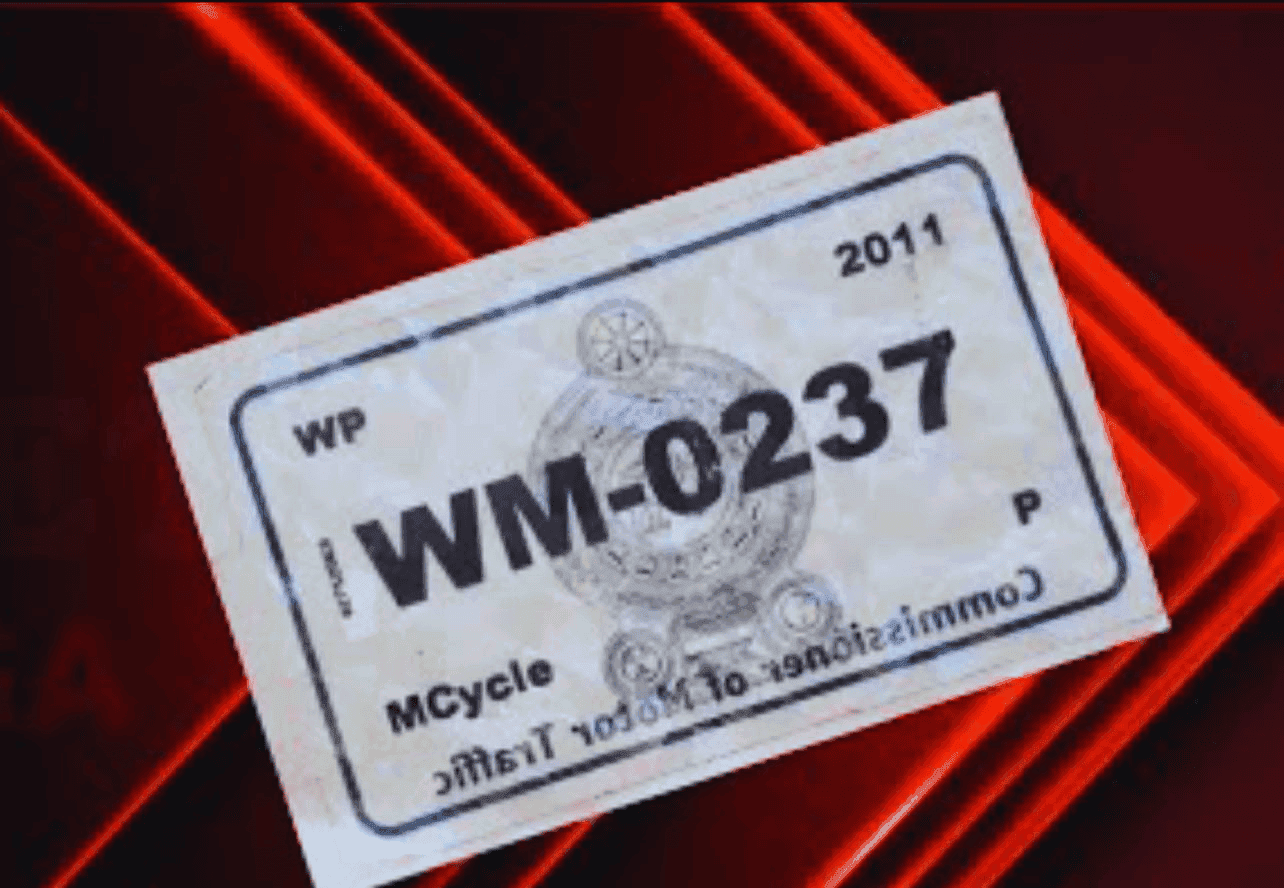

Notify your insurance company as soon as the damage occurs. Get instructions regarding their Claim Procedure and required documents (evidence photos, driving license copies, etc.).

Adjuster's Visit

The insurance company will send an adjuster to inspect the damage. Provide them with all the information and photos you recorded.

Total Loss vs. Repair

Based on the extent of the damage, the insurance company will make one of two main decisions:

1. Approval for Repair

If the repair cost is lower than the vehicle's current Market Value, they will approve the repair. At this stage, you must reach a clear agreement on the location authorized to repair your vehicle and the costs they will cover.

2. Total Loss

If the repair cost exceeds a certain percentage of the vehicle's value (usually between 75% and 85%)—for example, if a vehicle worth Rs. 4 million requires repairs costing over Rs. 3.5 million—the insurance company will declare it a Total Loss. In such cases, they will pay you the insured value of the vehicle and take ownership of the vehicle.

The Repair Process

Choose an Authorized Service Center: It is extremely important to choose a reliable service center approved by the insurance company that has experience in repairing flood damage.

Include All Parts: Ensure that all parts submerged in water, including electrical systems, the AC system, and the interior, are inspected and replaced as necessary.

By following these steps properly, you will be able to minimize financial loss and ensure that the repair work is carried out with transparency.