How Do I Get Insurance if My Vehicle Is Involved in an Accident?

Accidents can happen at any time when driving on the road. However, you cannot immediately claim insurance compensation, especially if the accident occurred due to your own fault. There is a proper procedure you must follow. Today, MotorGuide explains the step-by-step process of making an insurance claim if your vehicle is involved in an accident.

Types of Road Accidents Covered

The accidents we refer to here include:

- A collision between two vehicles due to driver negligence

- A collision with a fixed object such as a wall, tree, or pole

Regardless of the type, the process of filing an insurance claim remains the same.

Steps to File an Insurance Claim

1. Call the Insurance Company

As soon as an accident occurs, immediately inform your insurance company. Most insurers have a specific time limit for reporting accidents. If you fail to inform them within the given period, your claim may be rejected. In addition, you must also report the accident to the nearest police station.

2. File an FIR at the Police Station

A First Information Report (FIR) is a crucial document required to file a claim. Visit the nearest police station and file an FIR regarding the accident. The police will also inspect the accident site to verify if it was caused by negligence or a technical issue.

3. Take Photos of the Accident

Document the accident by taking clear photographs of the vehicle damage, accident scene, and any other visible impact. Submit these photos to the insurance company as supporting evidence for your claim.

4. Submit the Required Documents

To process your claim, the insurance company will ask for several documents, including:

- Copy of your driving license

- FIR issued by the police

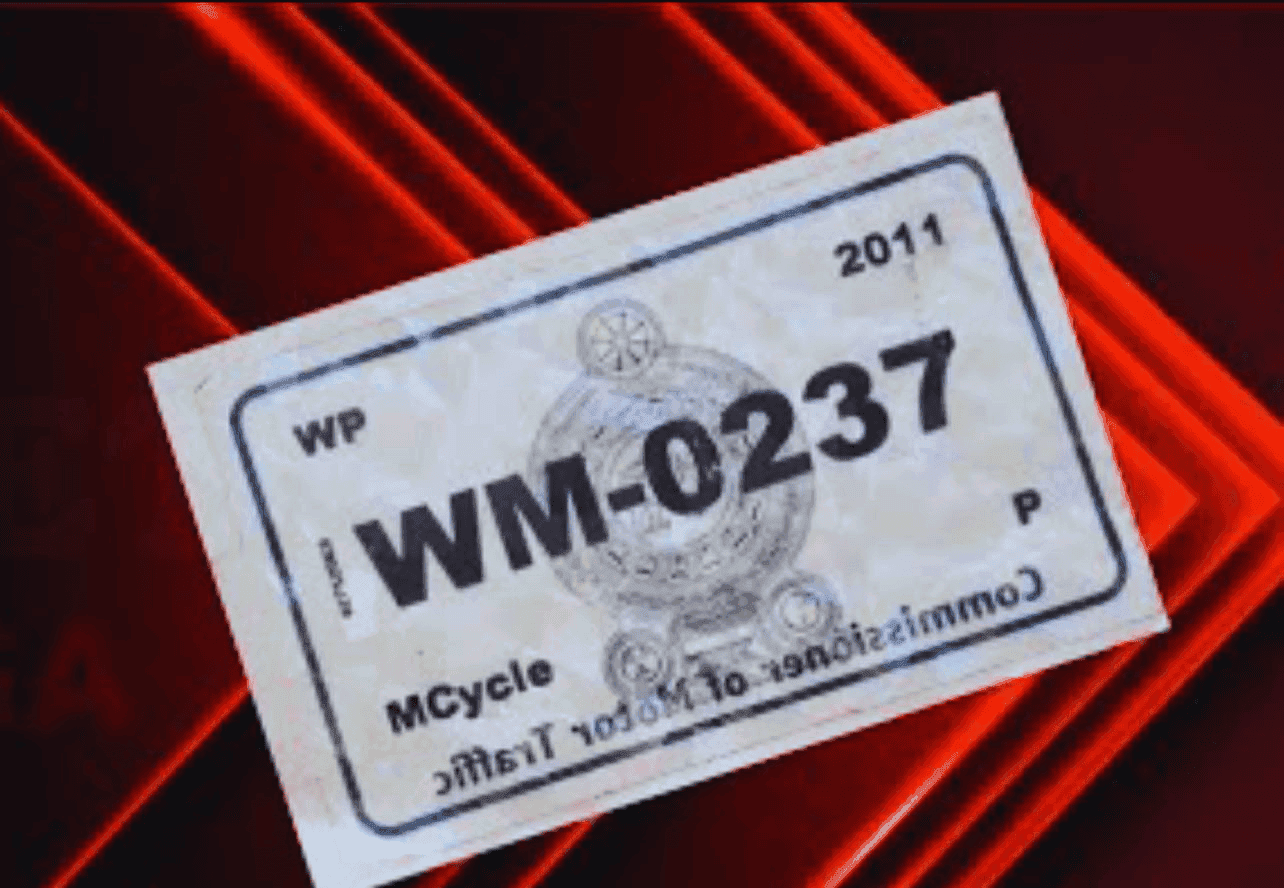

- Vehicle registration certificate (RC book)

- Your valid insurance policy

- Any other documents requested by the insurer

If you ever face an accident while driving, do not panic. Follow the above steps carefully, and you will be able to make a successful claim without unnecessary delays. Most importantly, always keep your vehicle insured and carry your documents when traveling.