How to Get a Vehicle Revenue License in Sri Lanka

Every year, vehicle owners are required to renew several important documents. Among them, one of the most essential is the Revenue License. Driving without a valid revenue license is an offense under the Motor Traffic Act. Therefore, from the first day you own a vehicle, it is mandatory to obtain and renew this license on time. Today, MotorGuide explains step by step how to get your vehicle revenue license.

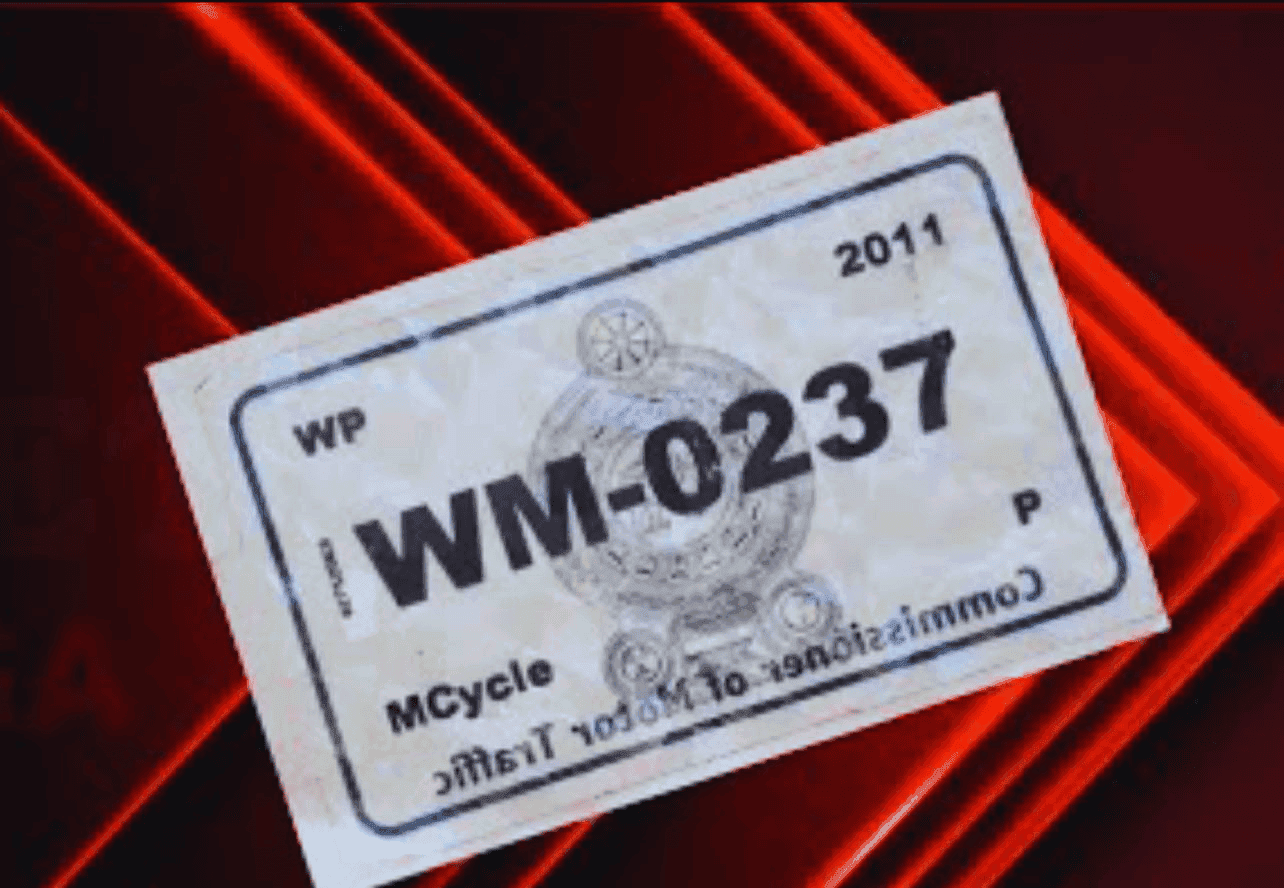

What is a Revenue License?

A revenue license is a legal document issued for one year from the date of vehicle registration. The start date is the date it was first issued upon registering the vehicle.

The license is also subject to certain conditions. For example, you must not use the vehicle in any way that violates the regulations printed on your license. Renewal can be done through any regional registry office within the province mentioned on your vehicle’s registration certificate.

Documents Required to Obtain a Revenue License

- Previous year’s Income Certificate

- Valid Insurance Certificate of the vehicle

- Vehicle Registration Document or a certified copy issued by the Commissioner of Motor Transport / financial institution

- Smoke Emission Certificate (issued within the last 60 days)

- If the vehicle was transferred from another province – an unbound copy issued by that province

- For passenger transport vehicles – a valid Road Permit

- For government vehicles bought at auction – purchase documents, payment receipts, and assigned documents

How to Apply

If you are registering a brand-new vehicle, you must first visit the Department of Motor Traffic (DMT) Head Office in Colombo for registration, regardless of your province of residence. However, motorcycles can also be registered at district Motor Transport offices.

After registering, you can obtain your revenue license from the Divisional Secretariat Office corresponding to the address on your registration certificate. Thanks to the online system, you may also renew it through any Divisional Secretariat Office connected to the network.

Penalties and Fines for Late Renewal

- Newly registered vehicles: The license must be obtained within 7 days. Failure to do so will result in a 10% fine of the fee.

- Over 6 months late (but less than 12): A 20% fine of the annual fee applies.

- Over 12 months late: A 30% fine of the annual fee applies.

Getting or renewing your vehicle revenue license is a simple process if you prepare the required documents in advance. By renewing on time, you avoid unnecessary fines, legal issues, and ensure that your vehicle remains roadworthy. Stay safe, stay legal, and drive with confidence.