Do I Really Need Car Insurance?

A vehicle can make your dreams come true and fulfill your daily needs. But at the same time, it can also cause an unexpected accident. Sometimes, it may happen because of your vehicle — or another vehicle on the road. That’s why the question arises: Do you really need to insure your car? Let’s break it down with MotorGuide.

What is Vehicle Insurance?

Vehicle insurance is financial coverage provided to a vehicle owner for damages to their vehicle or liabilities caused to others. In simple terms, it’s a way for the insurance company to compensate you when your car faces accidents, theft, fire, or other losses.

What Damages Are Covered by Vehicle Insurance?

Depending on the policy type, insurance can cover:

- Car accidents and collisions

- Internal fires and external explosions

- Lightning strikes

- Theft

- Damage caused by riots, terrorism, or civil unrest

- Natural disasters like floods or storms

Additionally, if the vehicle is damaged, most policies cover the cost of repairs and transportation up to a specified limit.

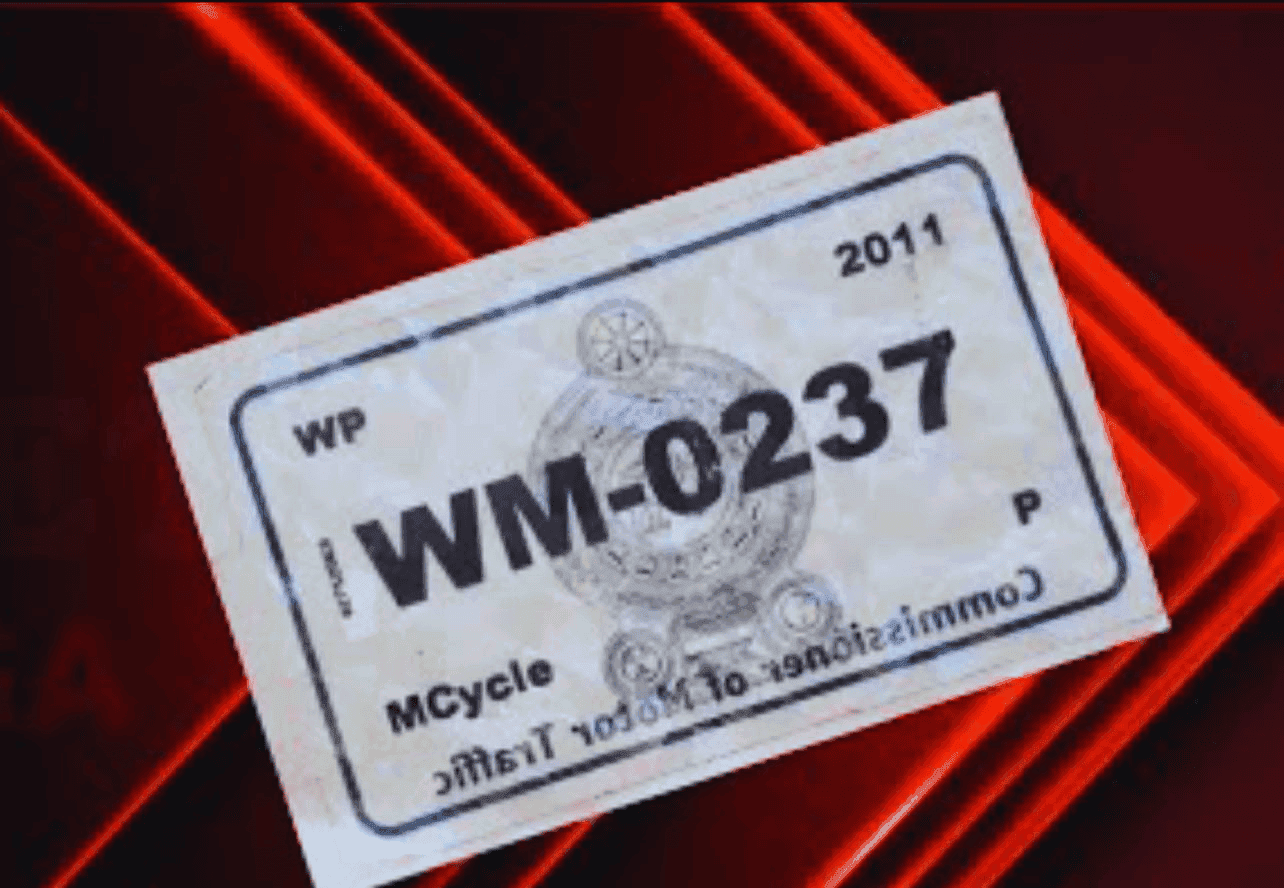

Types of Vehicle Insurance in Sri Lanka

There are three main types of vehicle insurance:

- Full Insurance – Covers accidents, fire, theft, riots, natural disasters, and third party damages.

- Third Party Insurance – Covers only the damage or injury caused to a third party by your vehicle.

- Third Party Fire & Theft Insurance – Provides limited coverage for third party damage plus fire and theft.

What is the Most Important Vehicle Insurance?

According to Sri Lankan law, you must have at least third party insurance to drive legally. Even though it doesn’t cover your own vehicle, it ensures the safety of others on the road. That’s why third party insurance is a must-have for every driver.

If your vehicle is leased, then full insurance is compulsory by law until the lease is fully paid off.

Is Motor Vehicle Insurance Really Necessary?

Absolutely. Road accidents are common, as police reports and daily news often confirm. Driving without valid insurance is a punishable offense under the Motor Vehicle Act. At a minimum, third party insurance is legally required, but having comprehensive coverage is the best way to protect both you and your vehicle.

Motor vehicle insurance isn’t just a legal requirement — it’s a safety net for you, your passengers, your car, and everyone else on the road. So, the next time you drive, make sure your car is insured. That way, if an accident happens unexpectedly, you’ll have peace of mind knowing you’re covered.