Things You Don’t Know About Full Insurance

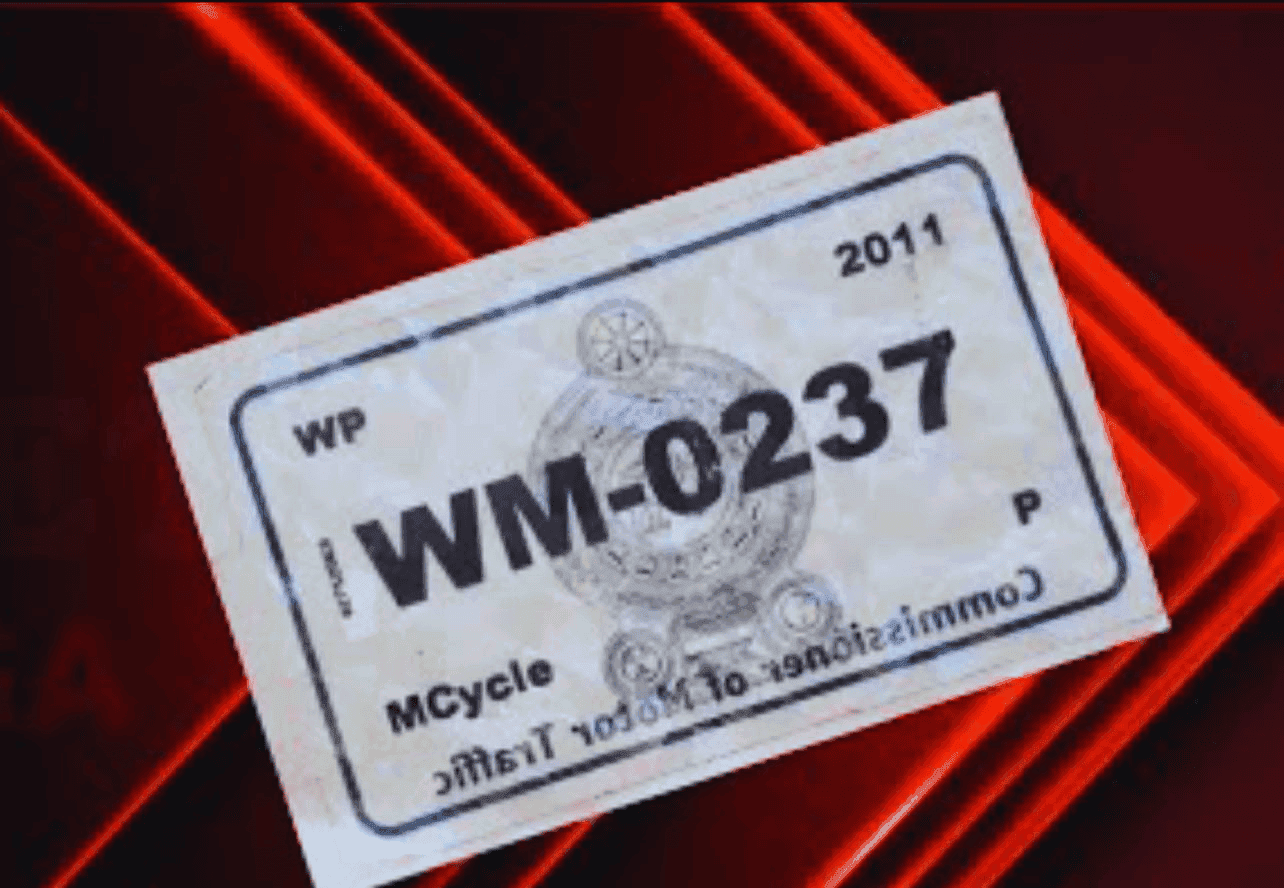

To legally travel on the road, a vehicle requires three documents: a valid license, a driver’s license, and motor insurance. According to the Motor Vehicle Act, driving without valid insurance is a punishable offense. Because of these laws—and to ensure vehicle safety—most people insure their vehicles. But many drivers don’t know all the details about full insurance. That’s why MotorGuide explains the lesser-known facts here.

What Is Full Insurance?

Full insurance offers wider coverage than basic third-party insurance. It typically protects against:

- Unexpected accidents

- Fire or theft

- Malicious or unintended damage

- Third-party injury or property damage

In addition to covering the insured vehicle, full insurance often extends to passengers, third-party lives, and external property.

Evidence Is Needed

After an accident, it’s normal to feel stressed. However, to successfully claim insurance, you must provide evidence. This includes:

- Taking clear photos of the damaged areas

- Notifying the insurance company immediately

- Providing details of the accident and any third-party damages

Without evidence, your claim may be delayed or rejected.

Don’t Run Away

If you’re involved in an accident, never flee the scene. Running away or reporting the accident much later may result in claim rejection. In some cases, a police report may be required to process your insurance claim. Always stay at the scene, gather information, and report promptly.

Full Insurance Coverage

When you take full insurance, the basic coverage generally includes:

- Damage to your vehicle

- Fire damage

- Theft or theft of vehicle parts

- Third-party damages

Coverage details may vary by insurance provider, so always check the policy before purchasing.

Added Options

Full insurance can be enhanced with optional add-ons. These may include coverage for:

- Floods and natural disasters

- Riots or civil disturbances

- Other special risks

If these are not included in your policy, you won’t receive compensation for related damages.

Transferring Full Insurance

If you sell your vehicle while it is covered by full insurance, the policy may be transferred to the new buyer. In some cases, you can also:

- Request a refund in cash

- Apply the insurance to your new vehicle

This option usually applies if the existing insurance policy has been used for less than 8 months.

When Insurance Compensation Is Not Paid

Full insurance does not cover every situation. Compensation will not be paid if:

- The driver was under the influence of alcohol (drunk driving)

- The driver did not have a valid license

- The accident involved a learner driver without proper supervision

In these cases, insurance companies have the right to reject claims completely.

Full insurance provides valuable protection against many risks, but it comes with conditions, exclusions, and responsibilities. By understanding how claims work, when coverage applies, and what is excluded, you can get the most out of your policy. If you’re considering full insurance, review the details carefully to ensure it provides the protection you need.

FAQs About Full Insurance

What is the main difference between third-party and full insurance?

Third-party insurance only covers damages caused to others, while full insurance covers both your vehicle and third-party damages.

Can I transfer my full insurance if I sell my car?

Yes. In most cases, the insurance can be transferred to the new owner, refunded, or applied to a new vehicle if used for less than 8 months.

Why would a full insurance claim be rejected?

Claims may be rejected if the driver was under the influence of alcohol, driving without a license, or if proper evidence of the accident is not provided.