Things You Need to Know About Third Party Insurance

As a vehicle owner, you already know that third party insurance is mandatory to drive on public roads. But do you fully understand how it works? Many drivers simply buy it because it’s required by law, without knowing the benefits and limitations. Today, MotorGuide explains everything you need to know about third party insurance, claims, and compensation.

What is Third Party Insurance?

Third party insurance covers financial losses, property damage, physical injuries, or legal liabilities caused by your vehicle to another person (the third party). However, it does not cover damages to your own vehicle or injuries to you and your passengers. Its primary purpose is to protect the third party in the event of an accident.

Can You Claim From Third Party Insurance?

Yes, but only under specific circumstances. There are two main types of compensation:

- Property Damage – Covers damage caused to another person’s property (e.g., a fence, another vehicle, or road infrastructure).

- Bodily Injury or Death – If the accident results in injury or loss of life to a third party, compensation is provided as per the policy.

Remember, third party insurance does not pay you for your own damages. It only compensates the affected third party.

How to Make a Claim?

If your vehicle is involved in an accident, follow these steps to process a claim:

- Inform the Police immediately and file a report.

- Proceed to Court, where liability will be determined.

- If you are found at fault, your insurance company will pay compensation to the third party.

- If you are not at fault, neither you nor your insurer is required to pay compensation.

The court, the insurer, and the policyholder all play a role in confirming liability and deciding the compensation amount.

Why is Third Party Insurance Required?

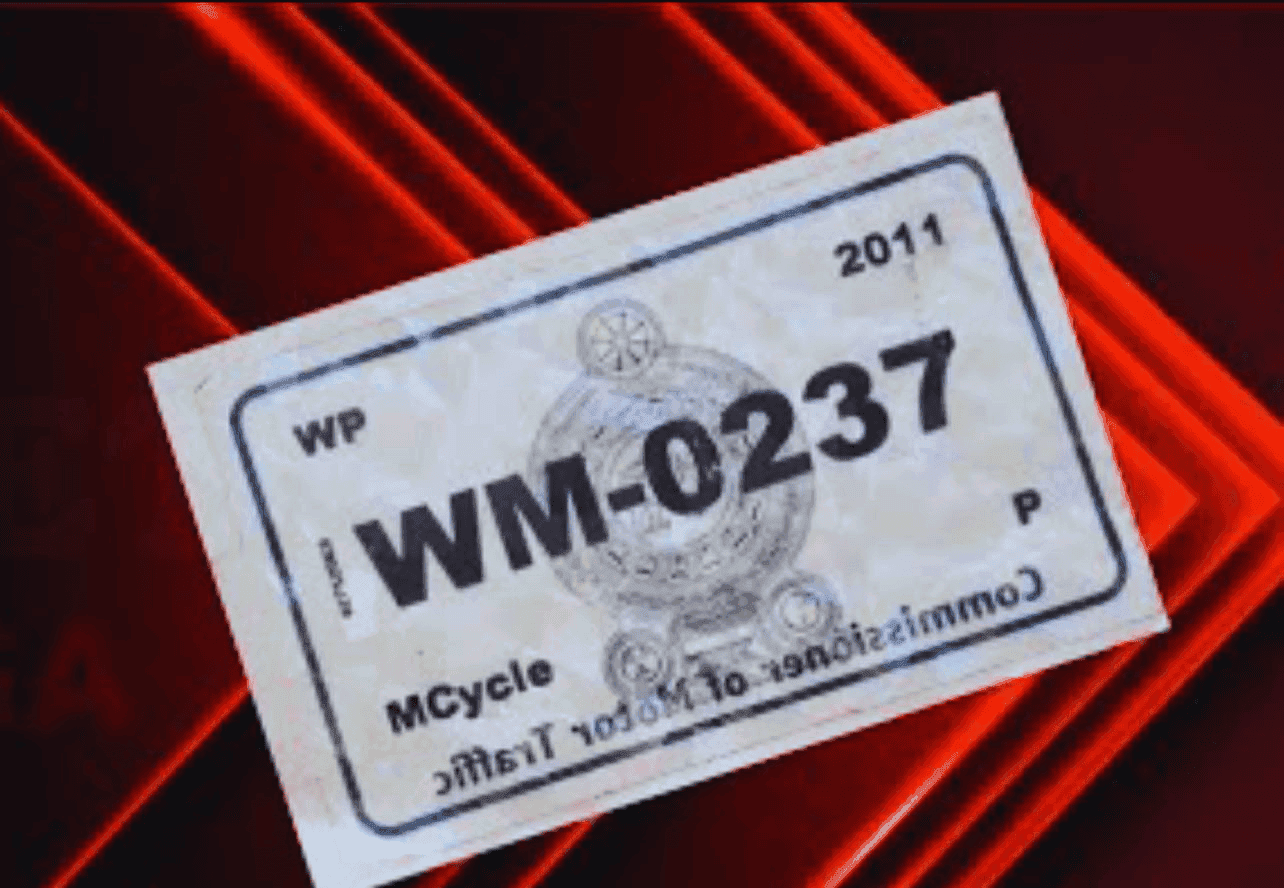

Driving without valid third party insurance is illegal. If the police stop you and you cannot produce proof of insurance, you can be fined. More importantly, if your vehicle causes damage to others, you would otherwise have to pay large amounts of money directly to the third party. This is why third party insurance protects both you and others on the road.

Compensation Limits

The amount of compensation varies depending on the type of damage:

- Bodily Injury or Death – Usually, insurance companies provide unlimited or maximum legal compensation.

- Partial Disability – A percentage of the maximum compensation is provided, depending on the severity.

- Property or Vehicle Damage – Compensation is capped at a specific limit as defined in your policy.

Always check the terms of your insurance provider to understand the maximum compensation entitlement.

Now you know that third party insurance is not just a legal requirement, but also a safeguard that protects you from paying heavy compensation out of pocket. While it won’t cover your own vehicle’s damage, it is essential for covering third-party losses and ensuring road safety. If you own a vehicle, make sure your third party insurance is always valid and up to date.