What is 3rd Party Insurance?

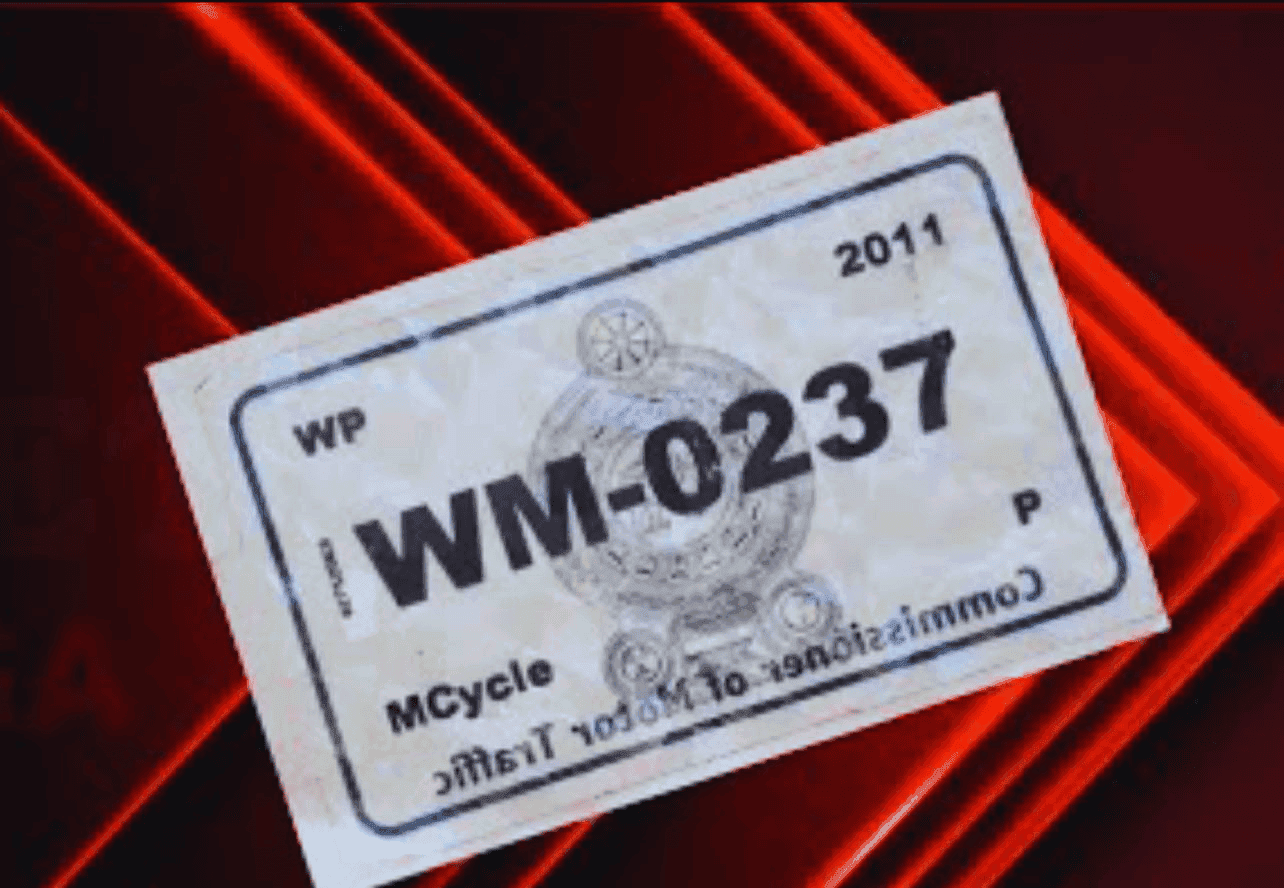

When you buy a vehicle—whether by saving your hard-earned money or through a bank loan—you also take on a big responsibility. Driving on the road always carries risk, and that’s why third party insurance is mandatory. In this article, MotorGuide explains what 3rd party insurance really means, what it covers, and why you must have it to drive legally.

Why Get 3rd Party Insurance?

3rd party insurance covers financial losses caused by your vehicle to another person (a third party). This can include:

- Property damage (fixed or movable)

- Bodily injury

- Death

- Legal liabilities

Driving without third party insurance is illegal. If you are caught, the police can impose fines and take legal action.

Can the Vehicle Owner Make a 3rd Party Claim?

Many people wonder whether they can claim compensation for their own vehicle under 3rd party insurance. The answer is no. This type of insurance only compensates other people (the third party) for damages caused by your vehicle. It does not cover repairs or damages to your own car.

What Do You Gain From 3rd Party Insurance?

Even though you cannot claim for your own vehicle, third party insurance still protects you financially. For example, if your car hits a wall, fence, or light pole, the damage may cost hundreds of thousands of rupees. Instead of paying out of your pocket, the insurance company covers the third party loss. This saves you from sudden financial stress.

Is There a Limit to 3rd Party Property Damage?

Yes, there is usually a limit. Most insurance policies cover third party property damage up to LKR 1,000,000. However, if the actual loss is higher, you may have to pay the balance yourself. To avoid this, you can request a higher coverage limit when taking or renewing your policy by paying a slightly higher premium.

Is 3rd Party Insurance Also Life Insurance?

In case of an accident where a third party suffers serious injury, disability, or death, the insurance company pays compensation. Unlike property claims, life-related claims usually do not have a strict upper limit. The court determines the amount, and the insurance company is required to pay it. In partial disability cases, compensation is given as a percentage, while in total disability or death, the maximum benefit is paid. In this way, third party insurance also acts like life insurance for others affected.

Will the Claim Be Paid Immediately?

No. The process takes time. After an accident:

- The case is reported to the police.

- The matter goes to court for investigation.

- If the court confirms that your vehicle caused the accident, the insurance company pays the third party according to the coverage limits.

This ensures fairness, but it also means claims are not paid instantly.

What If the Vehicle Owner Is Not at Fault?

If the court finds that the driver or vehicle owner is not responsible for the accident, the third party will not receive compensation. In this case, both the policyholder and the insurance company are released from liability.

3rd party insurance is compulsory in Sri Lanka. While it does not cover your own vehicle, it protects you from massive financial liabilities if your car causes damage to others. Think of it as a legal shield—ensuring that you stay on the road responsibly while avoiding unexpected financial burdens.