Advantages and Disadvantages of Leasing a Vehicle

When buying a vehicle, you generally have two options. The first option is to pay the full amount upfront and purchase the vehicle outright. The second option, especially if you don’t have enough money in hand, is to choose a vehicle lease through a leasing company. Leasing allows you to drive the car you want with smaller monthly payments, but it also comes with responsibilities and drawbacks. Today, MotorGuide explains the main advantages and disadvantages of leasing a vehicle.

Advantages of Leasing a Car

1. Low Monthly Payments

The biggest advantage of leasing is that you can use a vehicle without paying the full purchase price. Unlike taking a loan from a bank or private lender (which usually has high interest rates), leasing payments are often lower and can be adjusted to suit your income. This makes owning a vehicle more affordable in the short term.

2. Easy to Upgrade to a New Car

With leasing, you can switch to a newer vehicle more quickly. If you want to upgrade, you can transfer your leased car to another buyer through the leasing company. The new owner takes over the installments, while you can move on to a different vehicle under a new leasing plan.

3. Access to a Better Car

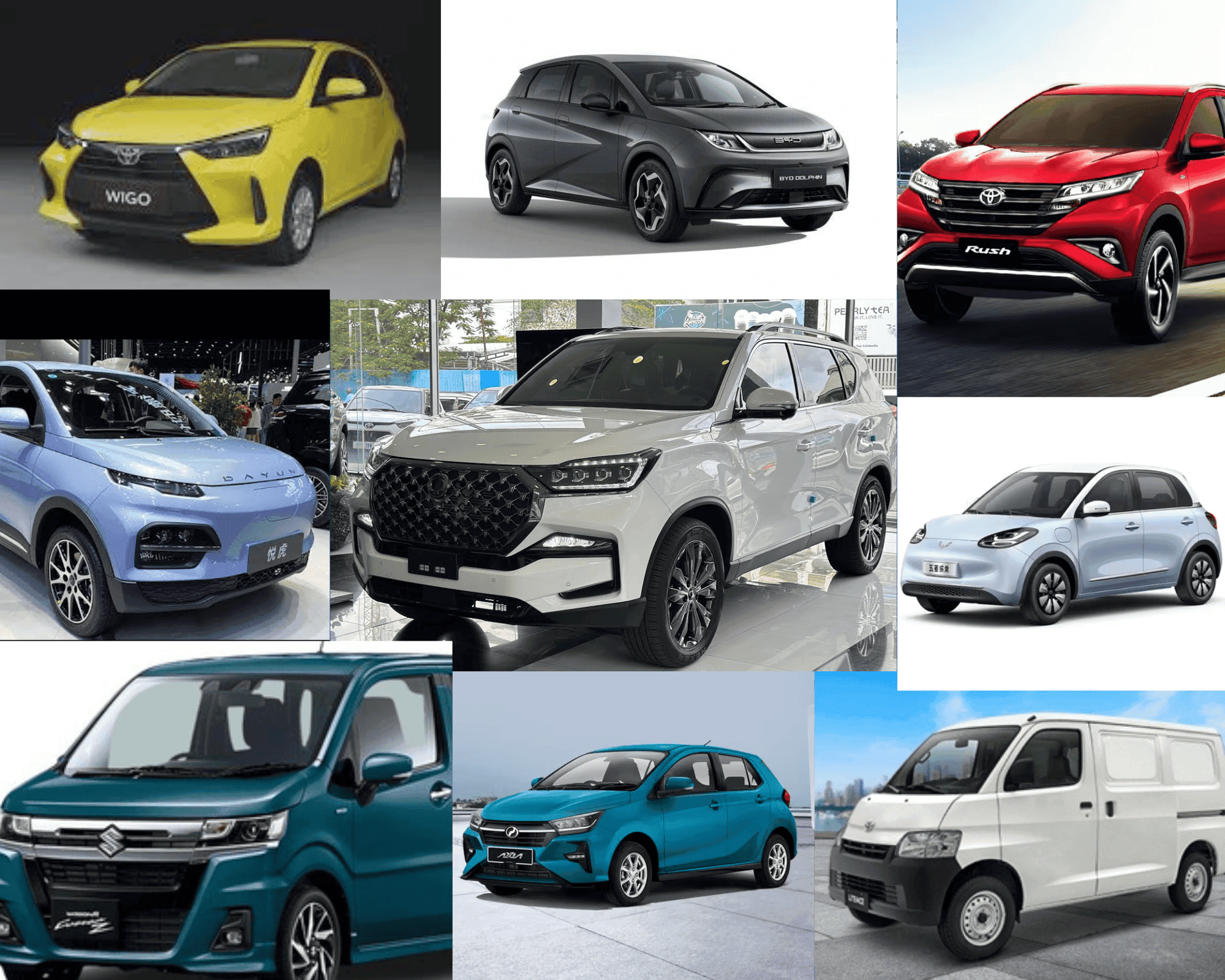

If your budget limits you from buying the car you want, leasing makes it easier. You can select a vehicle that better matches your income rather than being restricted to a lower-priced model when paying in full upfront.

4. Tax Benefits

When buying a car with a lump sum, you may face a higher income tax burden. However, with leasing, you can often receive tax relief since the payments are spread out, making the overall process less fina